Regulations in Digital Banking: White Paper for Banks Compliance

May 19th, 2020 | By Jscrambler | 2 min read

Digital banking results from the processes that banking and financial services are still undergoing for massive digitalization. This process finds some of its roots in the 2008 financial crisis.

With consumers’ trust in banks at a low point and banks freezing their innovation front, an opening was left for digital consumer banking services.

Enter neobanks, a new wave of fintech companies that develop web and mobile banking applications.

These facilitate the traditional banks’ overly complicated procedures and enhance the user experience by providing user-specific advice and spending analytics.

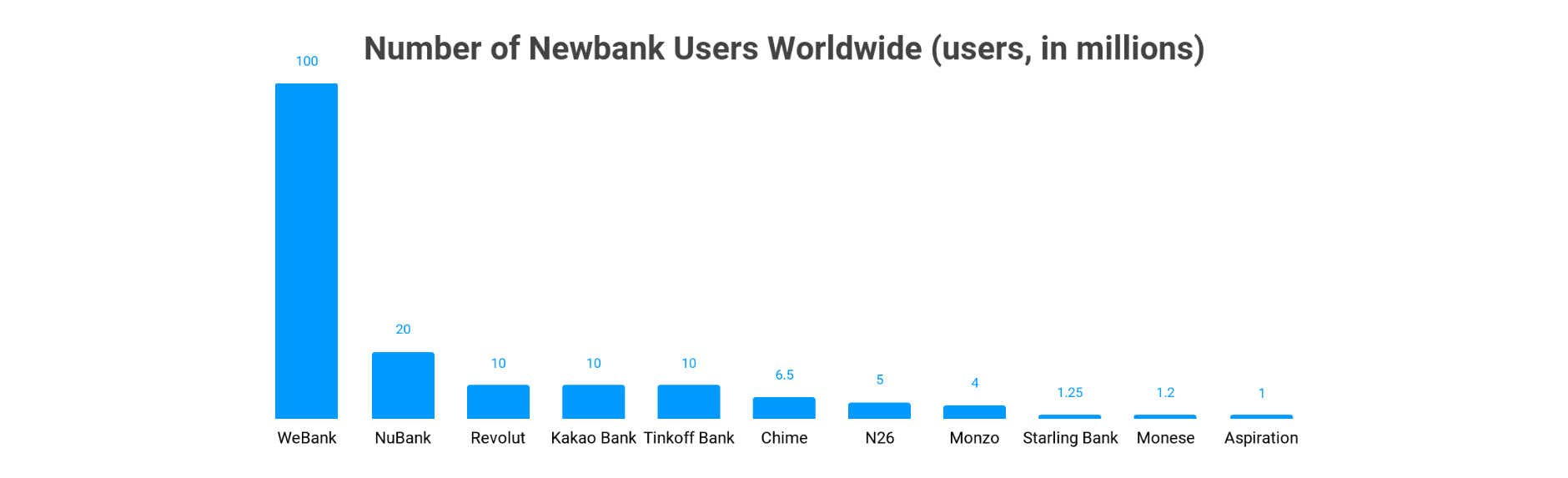

Neobanks are quickly gaining momentum in the market for consumer banking, amassing millions of clients globally.

Despite the many benefits that this shift has brought to consumers and the overall market, digitalization in banking services has highlighted the big question of data privacy and security.

Gigantic data breaches (notably Magecart attacks) are becoming more common. Consumers have grown more concerned about how their data is stored and used, especially their financial information.

From the standpoint of financial organizations (including Neobanks and fintech), the answer to this concern begins in the development stage of these digital banking applications, where secure development practices must be adopted.

Developing banking applications that deal with user data requires strict security practices.

And thanks to the emergence of several regulations and standards, this need for improved security of customer data is often not only recommended but an actual requirement.

Specifically, we find regulations directly related to the financial industry: PSD2, 23 NYCRR 500, and GLBA, as well as three regulations that are aimed at consumer privacy in general (which the financial sector is also subject to): GDPR, CCPA, and LGPD.

In this white paper, we explore the procedures to increase compliance by securing your banking apps, present the general goals of each regulation, and provide a summary of how organizations can accelerate compliance. We also cover standards such as ISO/IEC 27001, ISO 12812:2017, and the NIST Cybersecurity Framework.

We end the white paper by putting forward practical recommendations to increase compliance, reaching topics such as server-side security, network security, and client-side security.

Jscrambler

The leader in client-side Web security. With Jscrambler, JavaScript applications become self-defensive and capable of detecting and blocking client-side attacks like Magecart.

View All ArticlesMust read next

PCI DSS v4 Compliance: The Complete Checklist for Payment Pages

Ensure your e-commerce business meets PCI DSS v4. This complete checklist covers Requirements 6.4.3 and 11.6.1 for securing payment pages against e-skimming and Magecart attacks.

December 23, 2025 | By Nathan Coppinger | 15 min read

Preventing Digital Skimming Attacks and Enabling PCI DSS Compliance

E-commerce skimming = the majority of attacks against payment card data. The newest version of PCI DSS contains requirements aimed at preventing digital skimming attacks.

June 21, 2022 | By John Elliott | 5 min read